As it usually does this time of year, Intuit has introduced new versions of its Pro and Premier products. QuickBooks 2012 promises to help you get better organized, save steps, and acquire more in-depth financial insights.

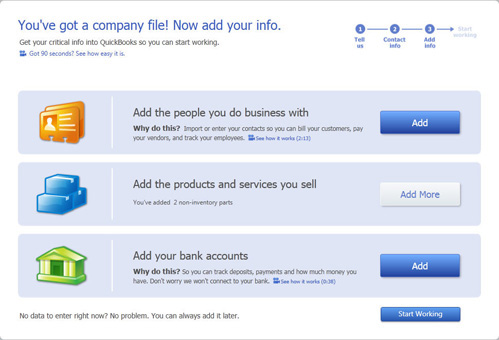

The new Express Start is designed for businesses that want to blast through setup and start entering customers and invoices. You have two other options though.

Advanced Setup is the old EasyStep interview that solicits more details. You can also open an existing file or convert data from Quicken or other accounting software.

Express Start requires minimal input. Company name, industry, company type, tax ID, and contact information is all that’s required. After you save your company file, it lets you start adding or importing customers/vendors/employees, products/services, and bank accounts.

Figure 1: Express Start simplifies company setup

An Activity-Driven Calendar

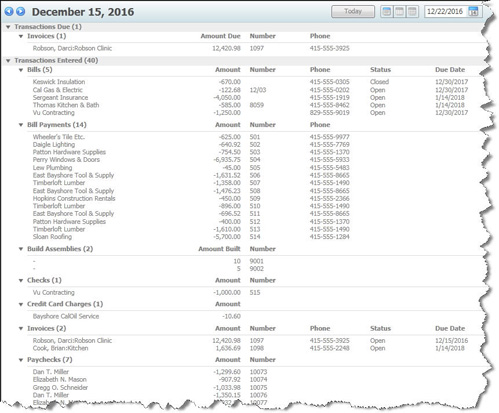

QuickBooks’ Reminders keep you apprised of each day’s tasks, but they don’t provide any information about the past or future. QuickBooks 2012 solves this problem with its new Calendar. When you enter an appointment, to-do, or key business task (invoices, bills, purchase orders, etc.), it appears in the calendar. You can display a graphical view of the month that tallies activities for each day and lists them below. Daily and weekly views are in list form and links open the original documents.

Figure 2: The new Calendar displays daily, weekly, and monthly views of your financial transactions

Save Excel Formatting

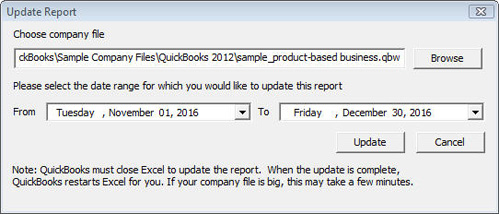

Once you’ve formatted a QuickBooks report in Excel, it’s frustrating to have to reformat it each time you run it for different time periods and/or with your ever-changing content. Excel Integration Refresh simplifies this process. You can now export a report to Excel, make formatting changes and save them, and then reapply them later to the same type of report using different date ranges and your updated QuickBooks data. Acceptable alterations include:

- Row and column header font formatting

- New formulas

- Renamed column and row headers, and report titles

- Resized columns

- Inserted columns and rows

- Inserted formula text

You can do this by opening your report in QuickBooks and clicking Update an existing worksheet, or by launching your report in Excel and clicking the QuickBooks tab on the toolbar, then the Update Report button.

Figure 3: This window opens when you click Update Report in Excel

A New Report Community

There’s always room for more report formats. QuickBooks 2012 offers a library of Contributed Reports, variations created either by Intuit or your fellow users. You can select one of these, like Customer Sales By Quantity By Item Detail and instantly populate it with your own data.

You can sort these templates by industry and rating, and view them as a list, in a grid, or in the Report Center’s Carousel view.

Centralized Operations

QuickBooks 2012 also saves you time with its new Centers. The Inventory Center works similarly to those available for customers, vendors, and employees. It’s a clearinghouse of item records and transactions that can be viewed and sorted. You can also do inventory housekeeping tasks here, like adding items and launching transactions.

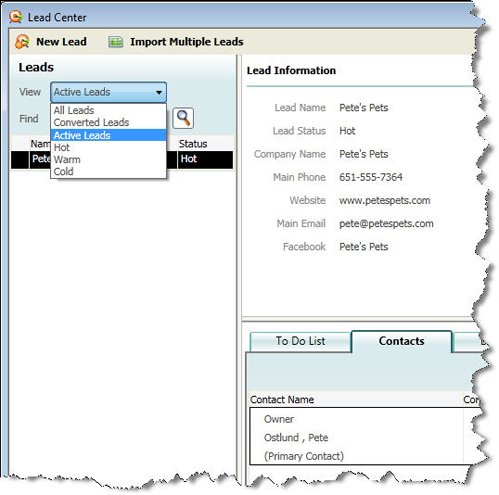

The Lead Center helps you carefully track new leads that you either paste in from Excel or enter manually. You can add to-dos and notes to contact records, and convert them into customers.

Upgrading Can Be Tricky

Intuit has included other, smaller time-saving organizational and reporting tools in QuickBooks 2012, like One-Click Transactions, which lets you create related transactions from existing ones (i.e., invoice to credit memo) with one click.

There’s nothing especially difficult about using most of QuickBooks 2012’s new features. But upgrading and setup are sometimes quirky, and the Excel Integration Refresh tool has a learning curve. We’re happy to help you start your company file on the right foot or get acclimated to this latest version.

Figure 4: Track your leads and convert them into customers in the new Lead Center