QuickBooks offers capable tools for tracking the items you sell, but it’s also quite a competent time-tracker. If you pay employees based on the hours they work, QuickBooks can ease your bookkeeping burden. Tracked time can flow to both invoices and payroll, helping you pay employees and collect on services provided to customers.

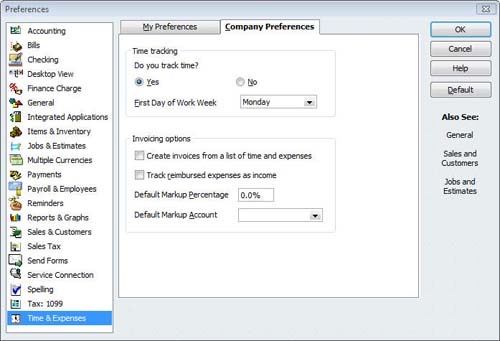

Before you start tracking time, you’ll need to turn on the related tools. Click Edit | Preferences, and then Time & Expenses. Click on the tab titled Company Preferences. You’ll see the window shown in Figure 1.

Figure 1: Before you can start tracking and billing for time, you’ll need to fill out some of the fields in this Company Preferences window.

In this window, be sure you’ve checked Yes, and then select the first day of the work week from the drop-down list.

If you are going to want billable time to flow directly to invoices, check the first box under Invoicing Options. The other options in this window relate to expense and item tracking; check with us to see if your business needs to use them.

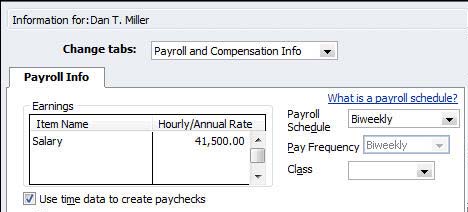

Tip: If you want to use payroll to pay employees for time worked, be sure to check the box labeled “Use time data to create paychecks” when you’re building employee records, as shown in Figure 2.

Figure 2: To facilitate the flow from time to paychecks, be sure to check the box for “Use time data to create paychecks.”

If you’re planning to use QuickBooks’s job tracking, click on Sales & Customers in the left pane, then on the My Preferences tab (see Figure 1). Here, you can choose how you want QuickBooks to handle available time and costs when you’re preparing an invoice.

Single Activities or Time Sheets?

QuickBooks offers two ways to enter time. You can record hours on individual tickets or fill out weekly timesheets. No matter which you choose, the information is always available in the other form. You can switch methods at any time, and your work will be preserved.

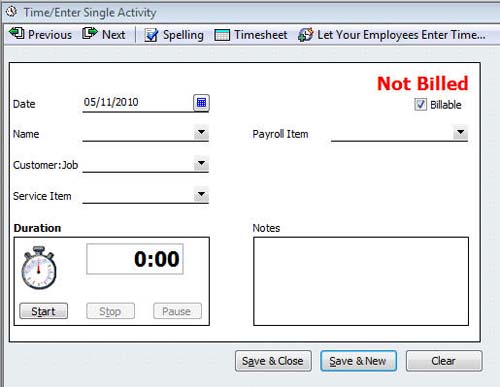

Let’s start with the individual time tickets. Open the Employee Center in the toolbar, or click on the Employees menu. Click Enter Time, then Time/Enter Single Activity. The window shown in Figure 3 opens:

Figure 3: It’s easy to record hours on this single-activity ticket by simply filling in the blanks.

QuickBooks pulls in data from other parts of the program, records you’ve already created. First, enter the activity’s date or select it from the calendar. Click the arrow next to Name and choose the appropriate employee from the list.

Second, if the hours are going to be billed to a customer or job, click the next arrow and select the correct one (ignore this if you’re just recording company time, like regular compensation or sick time). Finally, pick the service that the employee performed, if applicable. Be sure to check the Billable box when it’s appropriate.

Tip: You can create a new record on the fly here if, for example, you haven’t set up the service you need to record. Click < Add New > in the drop-down list.

Linking to Payroll

You can also use QuickBooks’s timer if you’re going to bill for a timed activity such as a phone call. And you can add notes that will be saved to the ticket.

QuickBooks provides other ways to describe hours spent so that they’re recorded properly. If you have payroll turned on and have associated a payroll item with the selected service item, the Payroll Item field (which indicates how much the employee should be paid) will automatically be filled in. You can easily change this field if necessary.

If you haven’t created a payroll item, select Add New. A wizard will walk you through the process. This relationship can be a bit confusing so talk to us if you have any questions. When you’re done, click Save & Close or Save & New.

Week at a Time

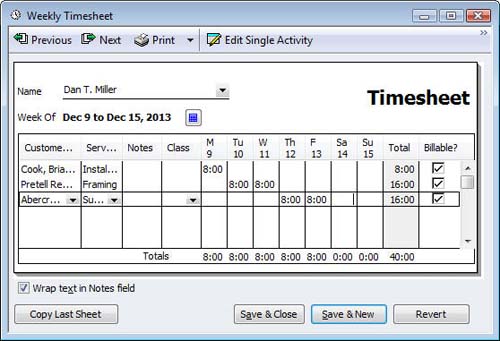

Weekly timesheets can save you a lot of time. To get there, open the Employee Center in the toolbar, or click on the Employees menu. Click Use Weekly Timesheet. You’ll see a window similar to the one shown in Figure 4:

Figure 4: Rather than entering each activity individually, you can document an entire week at a time using the Weekly Timesheet.

You can speed through weekly timesheets, using the drop-down lists to select the appropriate data and entering the number of hours worked. Click Copy Last Sheet if you want to duplicate the configuration from the last pay period.

QuickBooks Time Tracker offers another way to save time and avoid errors. Employees can send their timesheets from any computer that has an Internet connection. Your staff who handles payroll can then download and incorporate them into the company’s payroll. Prices start at $10/month for one user.

Whether you’re bringing employees in for seasonal help or your regular payroll incorporates time worked as well as items sold, QuickBooks contains the tools you need to both invoice customers accurately and dispatch proper paychecks.

If you need help with this feature, or you have any questions on QuickBooks’s reporting, don’t hesitate to give us a call.