Do you have a business plan? If you don’t, even if you’re a sole proprietor, you should.

Business plans can be a good barometer for the health of your finances as a way to gauge whether or not you’re on the right path. If you don’t have a business path (or if yours is less than organized or polished), you can use QuickBooks’ tools to create or fine-tune one. We’ll show you how to use these tools to get the job done quickly and easily.

The Game Plan

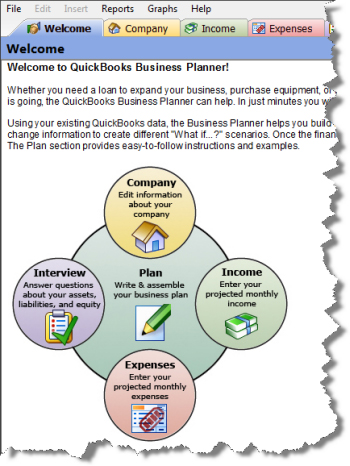

To get started, select Company > Planning & Budgeting > Use Business Plan Tool and you’ll see what’s displayed in Figure 1. QuickBooks’ business plan tool uses a convention that other Intuit products use frequently: a lengthy wizard that walks you through the entire process. This tool supplies information and asks questions about what’s needed on each screen. You fill in the answers (or select from options) and the business plan wizard works in the background to place the data in the correct place.

The first topic you’ll be asked about is your company. If you’re a new business, you’ll have to estimate in some areas, like the percentage of your sales that will come through credit. In other cases, you’ll be better able to answer in concrete terms. For example, what will your customer payment terms be? When do you want your business plan and financial projection to start?

Figure 1: QuickBooks walks you through the process of creating a business plan with an easy-to-use interface.

What’s Coming In?

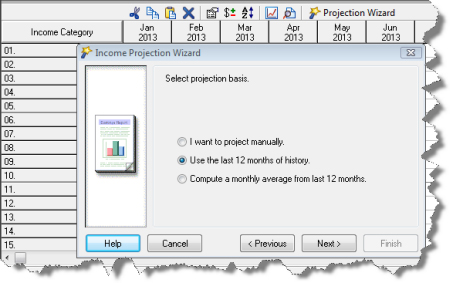

Your income is up next, and this will take some figure-pulling (and maybe some hair-pulling). You can either fill in a spreadsheet manually, adding up to 20 categories, or use the Income Projection Wizard, as pictured in Figure 2. If you’ve already been working with your data in QuickBooks, the latter is certainly recommended. These numbers will be scrutinized very carefully, perhaps put under the microscope more than any other element of your business plan. Make sure you can back them up.

Figure 2: The QuickBooks Income Projection Wizard.

If you’re projecting manually, be prepared to calculate the Cost of Goods Sold (COGS). This number contains three pieces:

- Material: What percentage of each dollar pays for the cost of product(s)? If you’re a service company, enter the associated materials costs.

- Labor: What percentage of each dollar is tied to the employee costs associated with goods production?

- Other: What percentage of each dollar goes into other costs?

Business Expenses and More

You have the same two choices when you’re entering your expenses. You can enter them manually or use the Expenses Projection Wizard. If you do the latter, your projections can be based on either the last 12 months of history or an average from the last 12 months.

In the Interview section, you’ll need to have numbers available, including:

- Beginning account balances

- Assets you own or need to buy

- Cash available to invest (if applicable)

- Amortization and depreciation

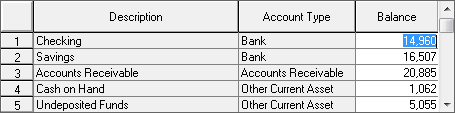

As in other areas of the business planning tool, existing data in QuickBooks will be automatically filled, such in Figure 3.

You’ll also answer questions here about inventory (i.e., fixed or variable, minimum balance), vendor financing, lines of credit, and your total credit limit.

Figure 3: The business planning tool pulls in existing data from QuickBooks.

Writing Your Plan

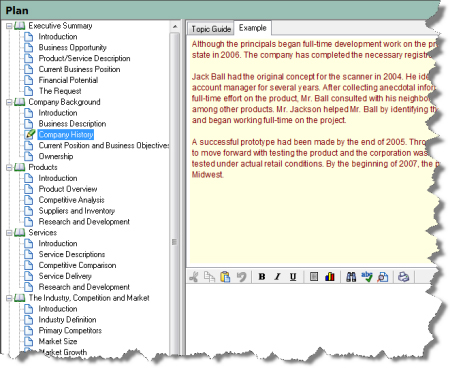

Now it’s time to write, but don’t panic thinking you’ll face a blank screen. The Plan section is divided into three sections, and you can toggle between them. You can view the actual plan outline tree, which is a window that provides tips and examples, as well as a text entry window, as shown in Figure 4.

Though this is primarily a text-based section including information about things like your company background, products and services, and the competition, you’ll supply some numbers, too, and the rationale for arriving at them.

Figure 4: The Plan section is divided into three main sections.

Once you’ve completed all of the sections, you simply preview and print your plan. QuickBooks assembles it with all of the text, tables, graphs, and charts in the right place, and presents you with a professional business plan that you can take to the bank, or simply revisit from time to time to make sure you’re on course.