Do you know how to detect and protect yourself from fraud? Most of us want to naively believe it will never happen to us. In reality, fraud impacts small and mid-size businesses far more often than large corporations. Why? Smaller businesses tend to take fewer precautionary measures to prevent fraudulent behavior.

Also, fraud is often perpetrated by a family member, long time employee, or friend that’s been given too much freedom with too few controls. However, you must not be naïve when it comes to your business. Fraud is very much a reality that can happen in your business.

In this article we’ll discuss how fraud happens, how to identify if fraud is happening, and what to do if you discover fraud has happened. We’ll also discuss some measures that you can take within QuickBooks to limit your exposure.

Why does fraud happen?

A combination of three aspects usually set the stage for fraud:

Opportunity: Companies often unknowingly present opportunities for fraud. In particular, small businesses are more prone to these because it’s harder to separate duties when you have a small staff.

Pressure: Personal pressures can put people over the edge and cause irrational thinking. Someone you know may be under duress due to medical and/or financial issues, or any of a number of other personal situations that influence their judgment.

Rationalization: The perpetrator believes they can rationalize their behavior, i.e. they need the money more then the company, the company won’t ever notice, or other insidious thoughts. Indeed, fraud often starts as a “loan”, with the perpetrator fully intending to “pay it back”.

Fraudsters will go to extreme measures to cover their tracks. Many small business owners believe it could never happen to them, as their employees are like family.

However, it is critical that you separate your thoughts with regard to what happens at work versus what happens outside the four walls of your business. No business is 100% safe.

What are five popular types of fraud?

- Claiming additional payroll hours or falsifying an employee.

- Stealing merchandise or cash.

- Giving unauthorized discounts to friends and family.

- Selling private business information to outsiders.

- Exaggerating on expense reports.

Although it’s often enticing to delegate tasks to subordinates, you should keep a hand in as many of your business practices as you can, even if it’s on a random basis. Fortunately there are some simple ways you can do so:

Payroll: Hand-deliver the paychecks, and use this as an opportunity to thank your employees for their work. This will help identify any “false” employees, as well as foster good will among your team.

Further, a process for tracking hours will help to minimize extra hours appearing on anyone’s time card. You might have a manager sign off on subordinate’s time sheets, or install a modern time clock that uses swipe cards or biometric identification.

Theft of cash or merchandise: Separate duties to the extent possible. Ideally those who receive money should be different than those who that generate invoices.

You should also try to separate inventory duties, and implement checks and balances for purchase orders, receiving and invoicing. Don’t rule out video surveillance of warehouse areas, even if it feels like “Big Brother.”

Unauthorized discounts: Track discounts given to customers. In QuickBooks:

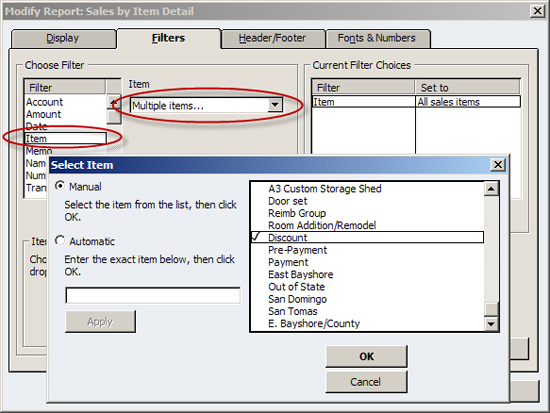

- Choose Reports, Sales, and then Sales By Item Detail.

- Click the Modify Report button, and then click the Filters tab.

- As shown in Figure 1, choose Items from the Choose Filter List.

- Select Multiple Items from the Item list, and then choose all discount and bad debt items.

- Click OK twice to view your report. If you find this report helpful, click the Memorize button and assign a benign name, such as Accounting Review.

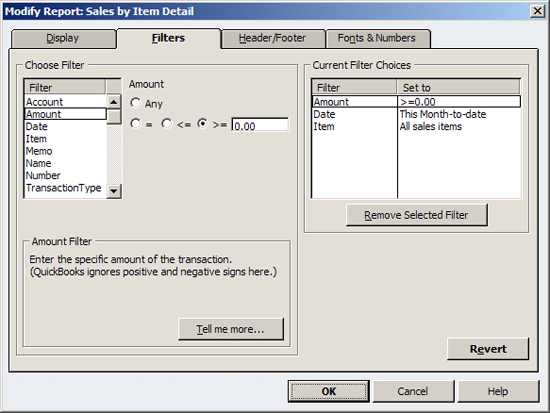

Figure 2 demonstrates another filtering technique for the Sales by Item report. Clear the Item filter, and specify Amount, and then >=0. This will display any negative or zero amounts listed on a customer invoice, as well as credit memo items.

It may seem counterintuitive to look for amounts that are greater than or equal to zero, but in accounting jargon, invoice amounts should always be credits to an account, which means they’ll be less than zero.

Negative items or discounts on an invoice post to your books post as debits, or positive amounts, which will be greater than zero.

Figure 1: You can filter the Sales by Item report to track discounts and other write-offs.

Figure 2: It’s also helpful to search for amounts that are equal to or greater than zero.

Selling private information: This is particularly difficult to guard against. One level of defense to require employees to sign confidentiality agreements at the time of hire that discuss what the company considers confidential and the consequences of violating said agreement.

Computer systems and paper work should also be protected with passwords, lock and key and whatever other measures may be warranted to minimize unnecessary access.

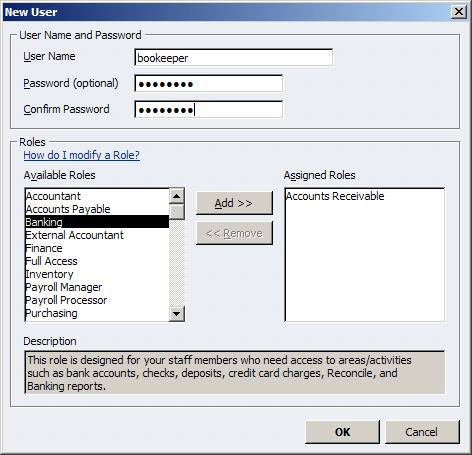

In QuickBooks, choose Company, Users, and then Set Up Users and Roles to assign unique log in names and passwords. As shown in Figure 3, QuickBooks offers predefined roles that automatically limit access to specified areas, but you can easily tweak a user’s role to meet their exact needs.

You should also require users to change their passwords periodically, and whenever possible, have your IT specialist restrict access to the folder where your QuickBooks data resides. However, do be aware that anyone can purchase a password recovery tool for $45 from www.lostpassword.com.

Figure 3: Use passwords in QuickBooks to limit employee access on a need-to-know basis.

Expense Reports: Always require receipts on all reports for reimbursement with no exceptions. You should also establish guidelines so that employees know when to seek approval so that they avoid the risk of unreimbursed expenses.

Unfortunately there’s no magic cloak that you can place over your business to protect it from fraud. Your best defense is to limit opportunities and remain vigilant. Fraud perpetrators have seemingly limitless imagination, so be sure that you’re always keeping a hand on the tiller of your business.