25 Accounting Terms You Should Know

QuickBooks is intuitive, easy to use, and flexible, but it is not an accounting manual or class or tutorial.

If your business is not particularly complicated, you might get by without knowing a lot about the principles of bookkeeping. Still, it helps to understand the basics, so let’s take a look at some terms and phrases that are helpful for you to understand.

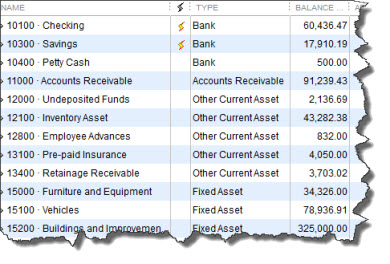

Account. You set up financial accounts like checking and savings in QuickBooks, but in accounting terms, these are referred to as the accounts in your Chart of Accounts: asset, liability, owners’ equity, income and expense.

Figure 1: A QuickBooks Chart of Accounts

Accounts Payable (A/P). Everything that you owe to vendors, contractors, consultants, etc. is tracked in this account.

Accounts Receivable (A/R). This account tracks income that hasn’t been realized yet, like outstanding invoices.

Accrual Basis. This is one of two basic accounting methods. Using it, you record income as it is invoiced, not when it’s actually received, and you records expenses like bills when you receive them. Using the other method, Cash Basis, you would report income when you receive it and expenses when you pay the bills.

Asset. What physical items do you own that have value? This could be cash, office equipment and real estate. In QuickBooks you’ll be managing two types. Current Assets are generally used within 12 months (or you could convert them to cash in that length of time). Fixed Assets refers to belongings like vehicles, furniture and land, property that you probably won’t use up in a year and which usually depreciates in value. Depreciation is very complex; you may need our help with that.

Average Cost. This is the inventory costing method that programs like QuickBooks Pro and Premier use to calculate the value of your stock.

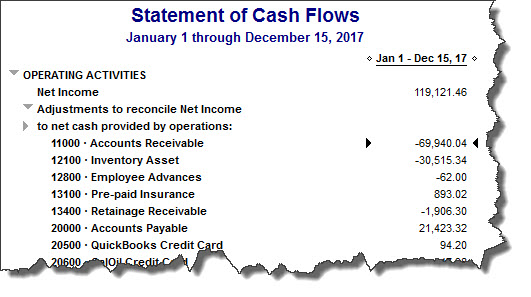

Figure 2: QuickBooks provides a Statement of Cash Flows report.

Cash Flow. This refers to the relationship between incoming and outgoing funds during a specific time period.

Double-Entry Accounting. This is the system that QuickBooks uses–that all legitimate small business accounting software uses. Every transaction must show where the funds came from and where they went. Each has a Credit (decreases asset and expense accounts) and Debit (decreases liability and income accounts) which must balance out (other types of accounts can be affected).

Equity. This refers to your company’s net worth and is the difference between your assets and liabilities.

General Journal. QuickBooks handles this in the background, so it’s unlikely you’ll ever be exposed to it. We sometimes have to create General Journal Entries, transactions required for various reasons (errors, depreciation, etc.) that contain debits and credits. Please leave that to us.

Item Receipt. You’ll create these when you receive inventory from a vendor without a bill.

Job. QuickBooks often associates customers with multi-part projects that you’ve taken on, like a kitchen remodel.

Net income. This is your revenue minus expenses.

Non-Inventory Part. When you purchase an item but don’t sell it or you buy something and resell it immediately to a customer, this is what it’s called. It’s merchandise that isn’t stored by you for future sales.

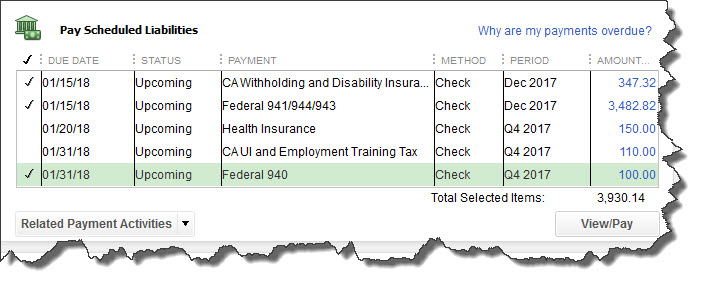

Payroll Liabilities Account. QuickBooks tracks federal, state and local withholding taxes, as well as Social Security and Medicare obligations, that you’ve deducted from employees’ paychecks and will remit to the appropriate agencies.

Figure 3: QuickBooks helps you track and remit Payroll Liabilities.

Post. You won’t run into this term in QuickBooks. It simply refers to recording a transaction within one of your accounts.

Reconcile. QuickBooks helps you with this. It’s the process of making sure your records and those of your financial institutions agree.

Sales Receipt. This is how you record a sale when payment is made in full during the transaction.

Statement. You’ll generally use invoices to bill customers in QuickBooks, but you can also send statements, which contain transaction information for a given date range.

Trial Balance. This standard financial report tells you whether your debits and credits are in balance. Should you run this report and find a problem, let us know right away.

Vendor. With the exception of employees, QuickBooks uses this term to refer to anyone who you pay as a part of your business operations.

These are just a few of the terms you should recognize and understand. We hope you’ll contact us when you need help understanding how the accounting process fits into your workflow.